Be smart and save money!

For the past five years I have shared various tips that will help you to make money online, and tips to save money when you are working as a blogger. In today’s post, I am going to share with you a variety of money-saving tips that are making the rich richer. I follow many of these money-saving tips myself, and if you’re not following them, then you’re losing money. So pay attention to the wisdom shared in this post, and start saving money today.

To begin, here are a few previously published articles for all bloggers who are interested in saving money:

Two of my favorite quotes are:

“A penny saved is a penny earned”, and “Time is money”.

In the following guide, I intend to help you to save money (and thus earn money!), by sharing tips that not only help you to release your old habits of overspending, but to build new habits that help you to save money consistently. Remember – your spending habits were not formed in one day, and they aren’t likely to be transformed in a day. But with dedication and consistency, you can succeed in saving money. And since a penny saved is a penny earned, you’re about to become richer by the day, as you as you start following these guidelines. So let’s get started!

How others are saving money to become rich:

For some, being “rich” means having a big house, a big car and a big bank balance. If you are wondering whether or not you’re rich, ask yourself this question: Right now, do you have more than you had last month? If the answer is yes, then you are on the right track. If the answer is no, then it’s time for you to get into introspection mode, and take a look at the habits that are causing you to lose more than you’re gaining.

I follow the guidance noted below as often as possible, allowing me to save money. You can do the same.

Avoid plastic money – use real money:

Whenever I go shopping in a mall, I usually use my credit card or debit card (plastic money) to pay for my purchases. This has little impact on me in the moment, because I am not parting with real money (cash), so I can spend more freely with little worry. Using plastic money also encourages me to buy non-essential items and to spend more than I should.

For the past few months I have taken to carrying cash with me while shopping, and I also set a budget for myself in terms of how much I will allow myself to spend. This way I focus only on items which I intended to buy. This is an essential tip, because giving away your hard-earned cash is harder than swiping your plastic card.

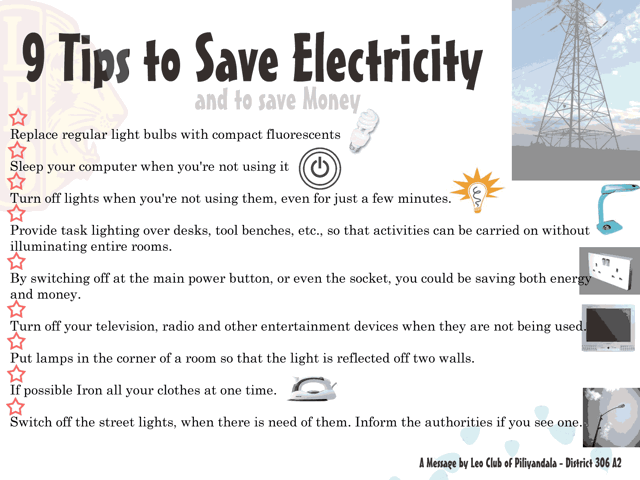

Save electricity, save money:

This one seemingly minor change has saved me more money than I ever thought possible. I was never a person who was diligent about turning off lights, the television, exhaust fans or even my Wifi router when not using them or when leaving my home. I was paying over 5000INR (78.35 U.S. dollars) every month for my electricity bill, which was too much for a single person living in a flat. I started practicing shutting down all electrical equipment when not in use or not needed, and that cut my bill significantly, bringing my monthly electric bill close to 3000 INR. This is a savings of almost 2000 INR/month ($31.34 U.S./month). I have been doing this for the past three months, and my total savings is already 6000 INR ($94.02 U.S.) Let’s do a quick calculation of protected savings by the end of the year:

While this may not seem like a significant amount of money to some of you, it is a considerable amount of money from my perspective, and an excellent savings over time.

Can you find better things to do with 24000 INR/376 dollars? I sure can!

Invest money into mutual funds or the equity market:

One of the biggest mistakes I made for years was not investing money in the right places. I used to have a fixed deposit with my bank account, and I thought I was enjoying a 9.25% interest rate on my deposited money. The problem with a fixed deposit is that you need to pay taxes on your interest. Considering the rate of inflation,n at the end of the day you end up earning close to nothing with your money.

I recently read a book entitled Rich Dad, Poor Dad, and that book changed my perception of money. I learned that it is a better idea to diversify my investments, which means investing my money into a variety of different areas such as the equity market, mutual funds or in the real market.

In December of 2014 I invested in my first piece of real estate worth 10 million INR ($156,700), and I am actively investing money in mutual funds.

It does not matter if you have 10,000 or 100,000 in your account, as long as you make sure to invest whatever you have in a vehicle that will allow you to make money from your investment. If you really want to be rich, you need to make money from your savings.

The biggest problem for me was that I was really not interested in learning about finance. I was just earning my living and paying my taxes like everybody else.

If you want to become rich and make money from your money, you need to learn about personal finance. It is not difficult to learn, and over time it will benefit you and your family very significantly.

You can start by reading some good blogs like Jagoinvestor and MoneyControl.

Next tip!

Avoid “buy 3 get one free” deals:

How many times have you gone shopping and encountered deals like “buy 3, get one free” or something similar, and you haven’t been able to resist your temptation to advantage of the offer? (Have you ever been out shopping when you have not seen such deals displayed??) Before you buy one extra item in order to get something for “free”, ask yourself if you really need that extra item.

You went out to buy one t-shirt, and ended up getting three for the price of two, but did you really need three t-shirts? “Wait! We have more for you!” is a proven psychological “trick” which causes marketers to earn more money and you to spend more money. In addition to paying out more of your money, you end up accumulating more stuff you don’t even need right now.

If you have this habit of buying extra stuff for a “deal”, it’s time to change that habit. Even if the amount you have to spend for the extra stuff is minor, you don’t need it, so don’t buy it! That’s less money spent and more money saved!

Your mobile phone usage:

One of the best ways to save money is by looking into the things which cost you indirectly. For example, a mobile phone is an essential item, and most of us end up buying that unlimited data package, a post-paid monthly plan and so on. I used to be a post-paid mobile user myself, and one thing I noticed is that I wasn’t keeping track of my usage. By the end of the month, I had to pay my bills and just forget about it.

For the past five years I have been a pre-paid user, and this has been an excellent change to my mobile expenditure. Now I have to top-up my mobile phone whenever necessary, and I don’t pay for unnecessary monthly usage.

This tip may not be reasonable for those who have very high mobile usage, but for a person like myself it can make a big difference. These days, topping up our mobile credit is easy with the help of apps (I use the PayTM app), and instead of buying an unlimited data plan or high-end data plan, we are only paying for what we actually need and use. Only you know your usage well enough to determine whether this could be a beneficial change for you, but you could save 500 INR ($10) a month on your mobile phone, which will mean a savings of 6000 INR ($120) by the end of the year.

Use a cash-back program for shopping online:

Whenever I shop online, I search for discount coupons and then pat myself on the back for saving some money. Recently I became familiar with cash-back programs like CashKaro which not only provide discount coupons, but also give cash back which can be deposited right into your bank account. Most recently I got cash-back of 15 INR (24 cents) along with a discount coupon of 20% on my pizza order. Was it a big savings? Every savings is a big savings to me. Only you can answer for yourself if it’s worth saving that extra penny without any extra work.

Look for for cash back programs in your country, and use then when shopping online. Most of these cash-back programs provide discount coupons too, so you end up saving significantly when shopping online.

Cut down on smoking and reward yourself:

Are you a smoker who is trying hard to quit smoking but fighting the dilemma of relapse? I have been a regular smoker since 2004, and it’s an addiction which is very difficult to break. I have tried quitting multiple times, and I have failed multiple times. Eventually I came up with a strategy that helped me to cut down considerably on my smoking habit, and has also worked as money-saving tip for me. Here is what I did:

This reward system has not only helped me to cut down on smoking, but it has also helped me to save a considerable amount of money.

If you have other habits like alcohol or drugs, you can try using the same reward mechanism, and notice the difference with this step in the coming days.

Saving money is a smart way to make more money. It is also a way to spend your hard-earned money only on things that matter.

These are the money-saving tips that are working for me, and if you apply them, they will work for you, too.

If you have your own tips for saving money, please share them with us in the comments section below!

If you find the information in this post useful, please share it with your friends and colleagues on Facebook, Twitter and Google Plus.

Comments

Post a Comment